Fray Guillermo

Madmaxista

- Desde

- 28 May 2008

- Mensajes

- 3.334

- Reputación

- 7.436

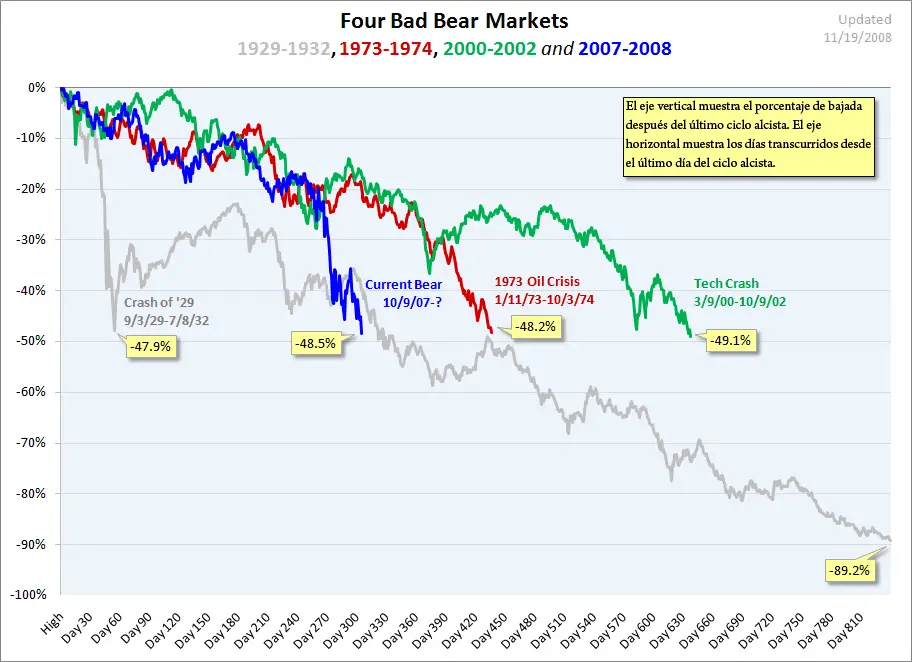

En la jerga bursátil angloamericana, "Bear Market" (Mercado del Oso) significa mercado bajista, es decir, situación en la que la bolsa va para abajo y sólo se puede jugar con posiciones cortas (entrar y salir rápidamente). Hay un consenso en que se entra en Bear Market cuando los principales índices han caído entre un 15 y un 20% con respecto al último pico, lo que precisamente sucede ahora en la Bolsa de Nueva York.

The Wall Strret Journal titula en su primera de hoy: El Dow Jones entra en territorio bajista (bear market) y anuncia penurias para la economía

online.wsj.com/public/us

Reuters: El Dow Jones entra en territorio bajista (bear market) www.reuters.com/article/ousivMolt/idUSN2732335520080627

Las tres etapas del mercado bajista

En Market Commentary hablan de las tres etapas del mercado bajista (bear market): negación, preocupación y capitulación. Creen que ahora se ha acabado la etapa de negación y se entra en la de preocupación. Afirman que la economía estadounidense ha entrado en recesión o que lo hará muy pronto.

www.comstockfunds.com

Nouriel Roubini: Lo peor está claramente por delante

Nouriel Roubini afirma que después del rescate del Bear Sterns se instauró una especie de autoengaño, de que "lo peor ha pasado", de que "la recesión será corta y que incluso evitaremos la recesión". Pero este autoengaño está desapareciendo rápidamente mientras los mercados financieros vuelven a entrar en pánico.

La razones que da el premio nobel son que hasta ahora sólo se estaban descontando pérdidas en las subprime, pero que también habrá que descontar pérdidas en los mercados prime, en las tarjetas de crédito, en los créditos a estudiantes, para coches. Habrá más pérdidas en las aseguradoras monoline, en los créditos industriales, en los bonos empresariales, en los CDS... Las pérdidas financieras serán superiores a un billón de dólares. Estas pérdidas apenas han empezado a reconocerse, sólo en el caso de las subprime. Centenares de bancos pequeños quebrarán (muchos de ellos tienen casi el 70% de sus activos en el sector inmobiliario). También bancos medianos y bancos comerciales están en riesgo.

Hasta ahora los inversores en instituciones como Lehman Brothers o otras pensaban que la FED actuaría como en el caso de Bear Stearns en caso de quiebra, pero no es seguro que lo pueda hacer de forma indefinida. Y si los inversores sospechan la FED no puede proporcinarles liquidez ilimitada, retirarán en masa sus dineros.

Por tanto, lo peor está claramente por delante, no por detrás, tanto para la economía real como para los mercados financieros.

www.thepinehillsnews.com/wp/2008/06/27/its-gonna-get-worse-out-there/

El mensaje para la economía estadounidense se podría resumir: "agarraos que vienen curvas fuertes"

The Wall Strret Journal titula en su primera de hoy: El Dow Jones entra en territorio bajista (bear market) y anuncia penurias para la economía

online.wsj.com/public/us

Reuters: El Dow Jones entra en territorio bajista (bear market) www.reuters.com/article/ousivMolt/idUSN2732335520080627

Las tres etapas del mercado bajista

En Market Commentary hablan de las tres etapas del mercado bajista (bear market): negación, preocupación y capitulación. Creen que ahora se ha acabado la etapa de negación y se entra en la de preocupación. Afirman que la economía estadounidense ha entrado en recesión o que lo hará muy pronto.

www.comstockfunds.com

Nouriel Roubini: Lo peor está claramente por delante

Nouriel Roubini afirma que después del rescate del Bear Sterns se instauró una especie de autoengaño, de que "lo peor ha pasado", de que "la recesión será corta y que incluso evitaremos la recesión". Pero este autoengaño está desapareciendo rápidamente mientras los mercados financieros vuelven a entrar en pánico.

La razones que da el premio nobel son que hasta ahora sólo se estaban descontando pérdidas en las subprime, pero que también habrá que descontar pérdidas en los mercados prime, en las tarjetas de crédito, en los créditos a estudiantes, para coches. Habrá más pérdidas en las aseguradoras monoline, en los créditos industriales, en los bonos empresariales, en los CDS... Las pérdidas financieras serán superiores a un billón de dólares. Estas pérdidas apenas han empezado a reconocerse, sólo en el caso de las subprime. Centenares de bancos pequeños quebrarán (muchos de ellos tienen casi el 70% de sus activos en el sector inmobiliario). También bancos medianos y bancos comerciales están en riesgo.

Hasta ahora los inversores en instituciones como Lehman Brothers o otras pensaban que la FED actuaría como en el caso de Bear Stearns en caso de quiebra, pero no es seguro que lo pueda hacer de forma indefinida. Y si los inversores sospechan la FED no puede proporcinarles liquidez ilimitada, retirarán en masa sus dineros.

Por tanto, lo peor está claramente por delante, no por detrás, tanto para la economía real como para los mercados financieros.

www.thepinehillsnews.com/wp/2008/06/27/its-gonna-get-worse-out-there/

El mensaje para la economía estadounidense se podría resumir: "agarraos que vienen curvas fuertes"